Property Transfer Expenses

Property Transfer Expenses

When purchasing property in Thailand, buyers should be aware of the transaction costs incurred at the Land Department during the ownership transfer process. These costs typically include:

- Transfer Fee: 2% of the registered property value, usually shared equally between buyer and seller unless agreed otherwise.

- Stamp Duty: 0.5% of the registered value if not subject to specific business tax.

- Specific Business Tax (SBT): 3.3% applies if the property is sold within 5 years of ownership.

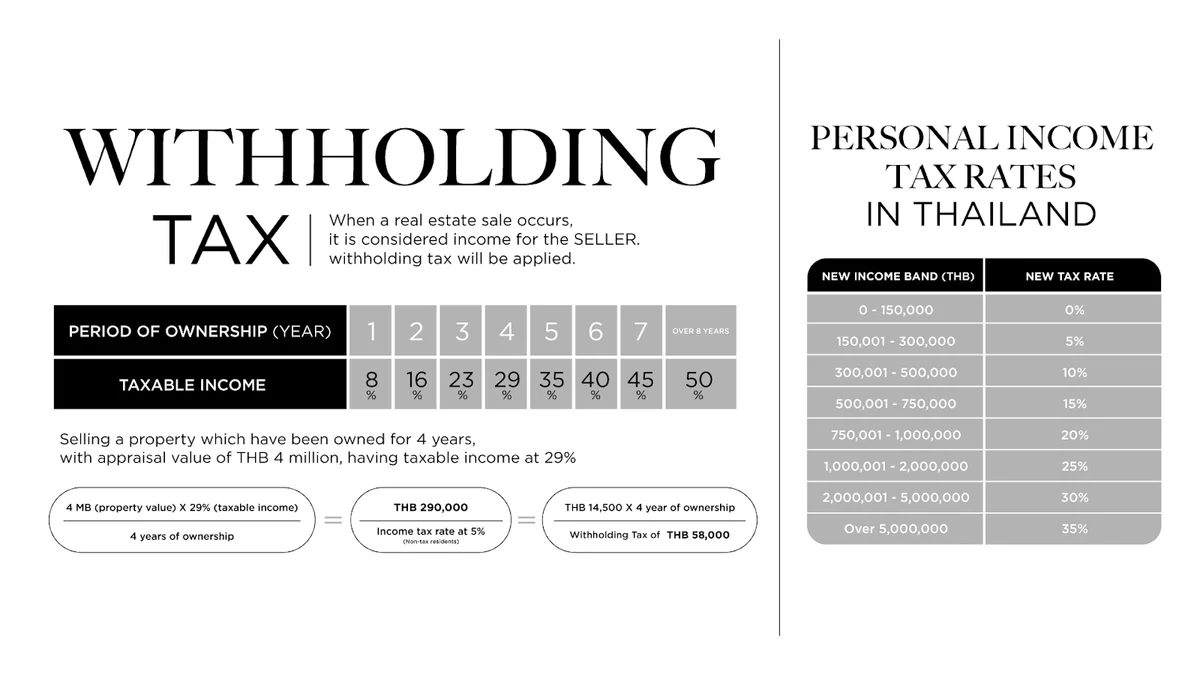

- Withholding Tax:

- If the seller is an individual:

WHT is calculated using a progressive personal income tax rate, based on a deemed income (after allowable deductions based on years of ownership). The rate starts at 5% and goes up to 35%, but the final amount is often lower due to deductions.

- If the seller is a company:

WHT is calculated at a flat 1% of the selling price or appraised value, whichever is higher.

Thai Land & Building Tax Rates

The Land and Building Tax in Thailand is an annual tax imposed on property owners based on the type and usage of the property. It applies to land, houses, condominiums, and buildings, whether used for residential, commercial, or rental purposes. The tax is calculated on the appraised value of the property and is collected by local authorities each year. While the rates vary depending on ownership type and purpose of use, all property owners—both individuals and corporations—are required to comply with this tax obligation.

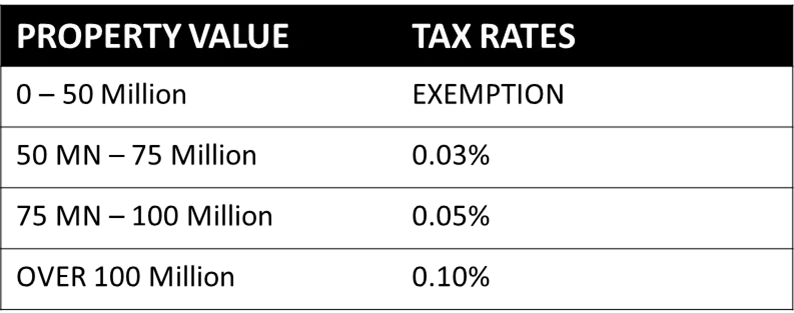

- Main Residence: for properties used as a main residence, where the owner’s name is on both the land and building title, Thailand offers favorable tax rates. Properties valued up to 50 million THB are exempt from the land and building tax. Properties valued between 50 and 75 million THB are taxed at 0.03%, and those between 75 and 100 million THB are taxed at 0.05%. Any main residence valued over 100 million THB is taxed at 0.10%.

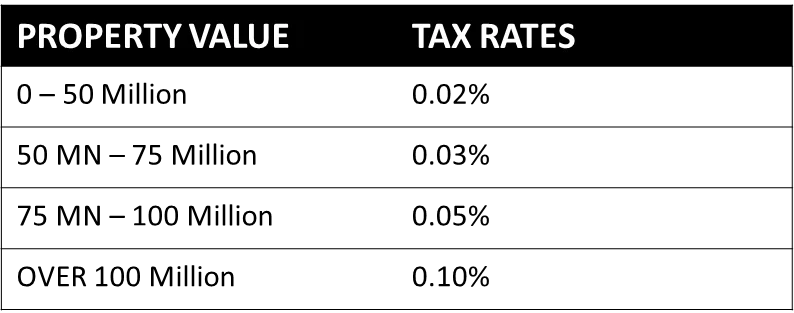

- Other Residence: For secondary homes or investment properties—where the owner’s name appears only on the title deed but not as the primary resident—the land and building tax is higher. Properties valued up to 50 million THB are taxed at 0.02%, those between 50 and 75 million THB at 0.03%, between 75 and 100 million THB at 0.05%, and over 100 million THB at 0.10%. These rates are applicable regardless of whether the property is rented out or left vacant.

- Corporate Ownership: If a property is owned under a corporate name, the tax rate is higher than for individual ownership. Properties worth up to 50 million THB are taxed at 0.3%. The rate increases to 0.4% for properties between 50 and 200 million THB, 0.5% for those valued from 200 to 1,000 million THB, 0.6% for values between 1,000 and 5,000 million THB, and 0.7% for properties exceeding 5,000 million THB.